Malaysia Goods And Services Tax

This page is also available in. There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions.

The Implementation Of Goods And Service Tax Gst Malaysia

Gst And How It Affects The Luxury Goods Industry In Malaysia Bagaddicts Anonymous

Malaysia To Impose 5 10 Tax On Goods 6 On Services Cna

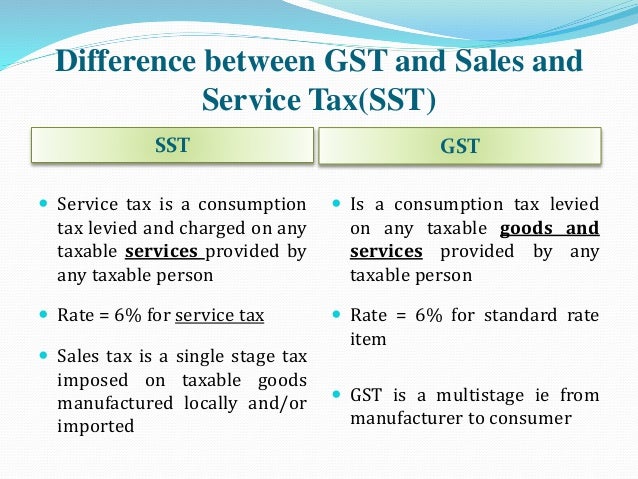

Comprehensive because it has subsumed almost all the indirect taxes except a few state taxes.

Malaysia goods and services tax. Tax planning is the process of looking at the available tax options in order to determine how the Company can conduct the business transactions so that taxes are eliminated or reduced. Melayu Malay 简体中文 Chinese Simplified Corporate Tax Planning in Malaysia. Establishment of Fund for Goods and services Tax Refund.

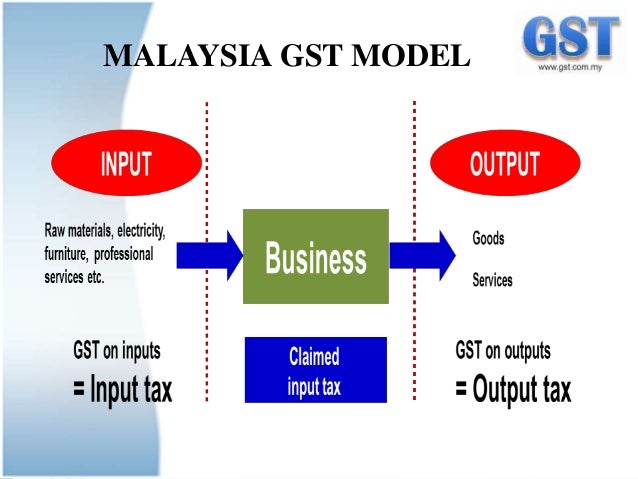

Goods and Services Tax or GST is a broad-based consumption tax levied on the import of goods collected by Singapore Customs as well as nearly all supplies of goods and services in Singapore. It is a comprehensive multistage destination-based tax. Then add goods or services details section that includes goods service details price per SKU quantity discount if any tax applicable if any.

Overview of Goods and Services Tax GST in Singapore. MSC Malaysia companies are eligible for incentives which include the following. EzHASil e-Filing is a most convenient way to submit Income Tax Return Form ITRF.

Goods and Services Tax GST is an indirect tax or consumption tax used in India on the supply of goods and services. Although the income is exempted from tax tax will have to be paid on the dividends paid on tax exempted income. GST exemptions apply to the provision of most financial services the supply of digital payment tokens the sale and lease of residential.

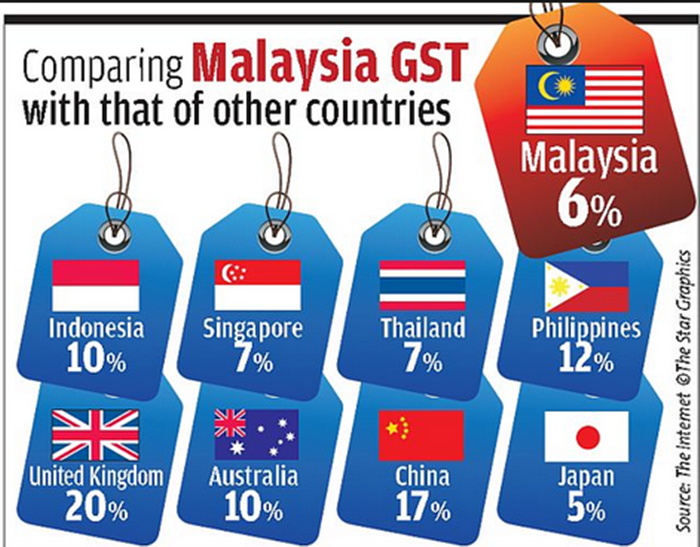

In other countries GST is known as the Value-Added Tax or VAT. It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form because all the calculation is automatic. FUND FOR GOODS AND SERVICES TAX REFUND.

Non-applicability of section 14A of the Financial. Goods and Services Tax or GST meaning is a broad-based consumption tax levied on the import of goods collected by Singapore Customs as well as nearly all supplies of goods and services in Singapore. The Goods and Services Tax GST implemented on July 12017 is regarded as a major taxation reform till date implemented in India since independence in 1947.

For instance use the product formula if you have multiple SKUs and their prices. Power to require security. Recovery of tax from persons leaving Malaysia.

To make your work easy and use this invoice as a template for future invoices you can use formulas. Income tax exemption for five years and extendable by five years on statutory income or value-added income derived from services provided in relation to core income generating activities for MSC Malaysia. In other countries GST is known as the Value-Added Tax or VAT.

Imported goods not to be released until tax paid. Liability of directors etc. Goods and Services Tax GST in Australia is a value added tax of 10 on most goods and services sales with some exemptions such as for certain food healthcare and housing items and concessions including qualifying long term accommodation which is taxed at an effective rate of 55GST is levied on most transactions in the production process but is in many cases refunded to all parties.

Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. Thank you for your support. We therefore advise you to whitelist the IBFD Tax Research Platform in your installed ad blocker for proper access to IBFD content.

A Guide To Gst In Malaysia How Does It Affect Me

Gst Better Than Sst Say Experts

How Does Gst Affect Real Estate Agents In Malaysia

Will Gst In Malaysia Be Similar To Singapore

Gst In Malaysia Explained

Ktemoc Konsiders Again For Gst

A Guide To Gst In Malaysia How Does It Affect Me

Goods And Services Tax Malaysia Gst Ts Mohd Nur Asmawisham Bin Alel

You have just read the article entitled Malaysia Goods And Services Tax. You can also bookmark this page with the URL : https://aylagwf.blogspot.com/2021/09/malaysia-goods-and-services-tax.html

0 Response to "Malaysia Goods And Services Tax"

Post a Comment